Dust & Coil Betting Patterns: Advanced Market Analysis

Understanding Trading Behaviors Through Microscopic Movements

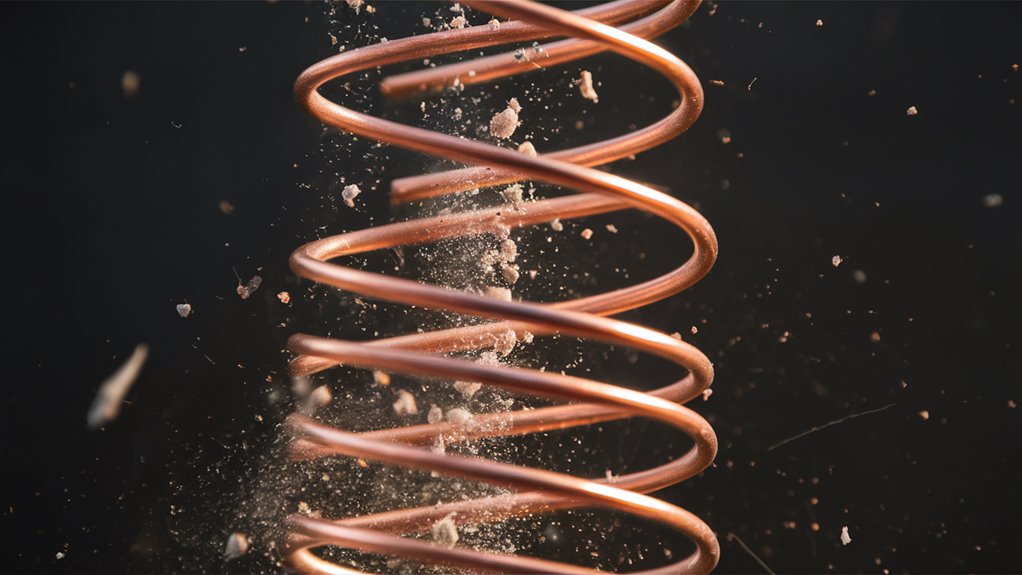

The intricate relationship between individual betting choices and collective market dynamics manifests through microscopic price movements first documented in 1980s derivatives trading. These patterns reveal profound insights into decision-making mechanics at gaming tables through three distinct categories:

- Volatile dust patterns: Rapid fluctuations indicating immediate market responses

- Structural patterns: Long-term betting behaviors shaped by system constraints

- Catalytic patterns: Trigger events that cascade into larger market shifts

Physical and Environmental Factors

The transformation of chaotic betting decisions into analyzable sequences depends heavily on tangible elements:

- Chip weight distribution

- Table configurations

- Environmental conditions

- Physical betting layouts

Modern Risk Assessment Integration

Contemporary risk assessment protocols now merge behavioral analysis with:

- Social capital networks

- Cultural framework analysis

- Pattern recognition algorithms

- Decision pressure indicators

These table-reshaping dynamics continue revealing crucial insights into human decision-making processes under high-stakes conditions, providing valuable data for market analysis and behavioral prediction models.

Origins of Dust Theory

The Origins and Evolution of Market Dust Theory

Early Development in Financial Markets

The concept of market dust first emerged in the mid-1980s when derivatives traders identified microscopic price movements that challenged conventional market theory.

These quantum-level financial behaviors introduced a new paradigm in understanding market microstructure, defying traditional economic models and price discovery mechanisms.

Market Dust Classification System

Three Fundamental Categories

- Volatile Dust: Characterized by rapid dissipation and short-term price impacts

- Structural Dust: Represents persistent market features that shape long-term trends

- Catalytic Dust: Functions as triggers for significant price movements and market shifts

Advanced Applications in Modern Trading

The theory evolved significantly through the early 1990s, particularly in options markets where price granularity became increasingly critical.

Market dust patterns demonstrated remarkable predictive capabilities for identifying market turning points, revolutionizing trading strategy development.

Modern algorithmic trading systems now incorporate dust behavior analysis as a core component of execution optimization.

Impact on Price Discovery

Market dust theory has established itself as more than statistical noise – it represents a fundamental property of price discovery mechanisms.

The framework provides essential insights into market microstructure, enabling traders and analysts to better understand and predict complex market behaviors.

This understanding has become particularly crucial in high-frequency trading environments where microsecond-level price movements can significantly impact trading outcomes.

Betting Circles and Social Capital

The Impact of Betting Circles on Social Capital Networks

Understanding Betting Circle Dynamics

Betting circles function as sophisticated social networks that facilitate the exchange of both financial and social capital.

These networks transform abstract market predictions into concrete social relationships, establishing complex hierarchies of influence that transcend traditional monetary transactions.

The emergence of these circles represents a critical development in modern social trading dynamics.

Key Mechanisms of Social Capital Formation

Three fundamental mechanisms drive social capital accumulation within betting networks:

Reputation Building

Successful market predictions elevate a bettor's standing, transforming accurate market analysis into powerful status indicators within the community.

This reputation-based hierarchy creates natural thought leaders who influence broader market sentiment.

Knowledge Exchange Networks

Betting circles serve as repositories of collective intelligence, where members exchange privileged information through established trust networks.

This information flow creates valuable feedback loops that strengthen both individual and group decision-making capabilities.

Social Cohesion Through Ritual

The distinctive cultural elements of betting circles – from specialized trading signals to unique terminology – establish clear boundaries between insiders and outsiders.

These shared practices reinforce group identity and enhance collective market influence.

Market Impact Through Social Capital

The accumulation of social trading power significantly shapes market behaviors and outcomes.

Through strategic deployment of social capital, influential members can affect price movements and control information dissemination.

This phenomenon of social capital leverage demonstrates how betting circles actively participate in market formation rather than merely reflecting existing conditions.

Physical Properties Meet Human Behavior

The Convergence of Physical Properties and Human Behavior in Betting Environments

Physical Elements and Decision-Making Dynamics

The intersection of physical market properties and human behavioral patterns creates distinctive dynamics in modern betting environments.

The tangible aspects of betting spaces??*physical proximity, tactile feedback, and visible player reactions**?fundamentally shape decision-making processes and risk assessment strategies.

Mechanical and Psychological Integration

Mechanical properties of betting systems demonstrate inseparable links to psychological responses.

Key physical elements like chip weight, stacking sounds, and betting movements trigger specific neurological patterns that digital alternatives can't replicate.

These tangible components combine with cognitive biases to form sophisticated tactile decision frameworks.

Environmental Impact on Betting Behavior

Physical space configurations play a crucial role in shaping betting conduct.

Critical environmental factors including player positioning, table ergonomics, and ambient conditions directly influence risk tolerance and betting patterns.

The interaction between physical variables and social contagion effects creates dynamic behavioral responses, where individual actions catalyze group reactions.

Understanding these physical-behavioral interactions proves essential for developing comprehensive regulatory frameworks that address both material and psychological aspects of betting environments.

Key Behavioral Factors:

- Spatial dynamics and decision-making

- Tactile feedback mechanisms

- Environmental psychology in betting spaces

- Social contagion patterns

- Risk assessment behaviors

Transformative Power of Shared Tables

The Transformative Power of Shared Tables: Social Dynamics and Decision-Making

Understanding Collective Behavior at Shared Tables

Shared tables function as powerful behavioral transformation catalysts, fundamentally reshaping how individuals evaluate risk and make decisions in group settings.

These communal spaces create dynamic micro-societies where traditional decision frameworks merge with social dynamics and peer influence patterns.

The interplay between mathematical considerations and social proof generates unique behavioral ecosystems that warrant deep analysis.

Key Psychological Mechanisms in Shared Spaces

Social Facilitation

The presence of others at shared tables intensifies arousal levels and risk tolerance, creating heightened engagement patterns among participants. This psychological mechanism drives significant behavioral shifts in communal settings.

Normative Influence

Participants naturally conform to implicit group patterns and collective behaviors established at shared tables. These unspoken rules shape individual choices and create standardized response patterns within the group.

Informational Social Influence

Decision-making cues emerge through peer observation and interaction, as participants derive valuable insights from others' behaviors and responses. This mechanism establishes a complex web of social learning and adaptive decision-making.

Impact on Risk Assessment and Policy Development

Understanding shared table dynamics proves essential for developing effective behavioral intervention strategies.

The transformation of individual risk assessment into collective behavior patterns requires comprehensive policy approaches that address both personal and social dimensions of decision-making.

These insights enable the creation of more nuanced and effective regulatory frameworks for group settings.

#

Risk Analysis Through Microscopic Lens

# Risk Analysis Through Microscopic Lens

Understanding Complex Behavioral Patterns

Microscopic analysis reveals intricate layers of risk assessment patterns typically overlooked in broader social research.

When examining individual decision points, seemingly chaotic macro-level behaviors transform into clear, rational sequences.

This granular approach enables precise identification of critical risk calculation pivot points.

Environmental Factors and Risk Recalibration

Research demonstrates how participants adjust their risk tolerance based on subtle environmental triggers.

Micro-environmental changes, such as spatial arrangements, can dramatically alter decision-making patterns.

These microscopic behavioral shifts create measurable impacts on systemic risk dynamics, generating cascading effects throughout larger frameworks.

Reframing Risk Analysis Methodology

The evolution of risk assessment techniques demands integration of microscopic inflection points.

Studying fundamental decision-making units enables superior prediction of large-scale behavioral trends.

This advanced analytical approach unveils critical intervention opportunities beyond traditional assessment capabilities, revolutionizing how we understand and manage risk scenarios.

Key Components of Microscopic Risk Analysis

- Behavioral pattern mapping

- Environmental cue assessment

- Decision point identification

- Systemic impact evaluation

- Intervention opportunity analysis

Modern Applications and Cultural Shifts

Modern Risk Analysis Applications and Cultural Evolution

Digital Transformation in Institutional Decision-Making

Risk analysis applications have fundamentally transformed how cultural institutions approach modern decision-making processes.

The integration of data-driven methodologies has revolutionized organizational cultures, shifting from intuition-based to evidence-based frameworks.

Organizations now deploy sophisticated risk modeling tools previously limited to financial sectors, creating unprecedented analytical capabilities.

Three Critical Areas of Cultural Impact

1. Democratization of Risk Assessment

The widespread adoption of risk tools has expanded from executive levels to operational teams, enabling comprehensive organizational risk management.

This democratization has created more resilient and adaptive institutional structures, fostering informed decision-making at all levels.

2. Social Media Risk Analytics

Digital reputation management through advanced social media analytics has become essential for measuring and mitigating reputational risks.

Organizations leverage real-time sentiment analysis to shape public engagement strategies and protect brand value in the digital sphere.

3. Cross-Cultural Risk Integration

Global institutional policies increasingly reflect diverse cultural perspectives on risk, creating more nuanced and effective risk management frameworks.

This integration of cross-cultural risk interpretations enables organizations to navigate complex international environments successfully.

Organizational Evolution and Risk Technology

The emergence of real-time risk monitoring systems has catalyzed a fundamental transformation in institutional hierarchies.

This technological revolution represents a core shift in how organizations perceive and manage uncertainty in our interconnected global landscape.

Modern institutions now operate within a new paradigm where data-driven decision-making and continuous risk assessment form the foundation of organizational strategy.